Rsu tax calculator

This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised. A restricted stock unit or rsu is a hypothetical share of verizon common stock.

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Carol Nachbaur April 29 2022.

. Many employees receive restricted stock units RSUs as a part of their compensation particularly in the tech industry. Rs 50 notional gain and perqs taxed accordingly. You will be paid 30 shares on 122020 at which point you can calculate the actual value by multiplying 30 shares by the closing stock price on 122020.

500 20 10000 החלק החייב במס שולי. We created a free excel tool to help with that. RSUs are taxed as W-2 income subject to federal and employment tax Social Security and Medicare and any state and local tax.

How is tax calculated for RSUs awarded by MNCs outside India. Feb 08 2022 amazons rsus currently vest 5 after the first year 15 after the second and then 20 every six months for the remaining two years. If population exceeds 10 lakhs but up to 25 lakhs.

To use the RSU projection calculator walk through the following steps. How Are Restricted Stock Units RSUs Taxed. When your restricted stock units vest and you actually take ownership of the shares two dates that almost always coincide the value of the stock at that vesting date gets included in your income for the year as compensation.

For senior citizens the exempt income is rs 3 lakhs and for super. מכיוון שעברו שנתיים הם כפופים לסעיף 102. מס רווחי הון יהיה 90000.

Now that you know the basics of how RSUs work you can now confidently use the RSU Tax Calculator Below. 1000000 Less Income Tax 62. 500 180 90000 החלק החייב במס רווחי הון.

מס שולי יהיה 10000 47 4700. 02 then your tax bill will be 2000 or Deferral of Share Issuance - Companies or organizations can issue restricted stock units without diluting the share base Founded in Chicago in 1924 Grant Thornton LLP is the U Calculate the Weighted Average Cost Of Capital WACC 33 The IRS has released new tax withholding tables and will require. The beauty of RSUs is in the simplicity of the way they get taxed.

Total RSU Value Before Tax. Compare how the total payout may change between options and RSUs. Enter the amount of your new grant whether an offer grant or an annual refresh.

Ad Thinking of switching from stock options to RSUs restricted stock options. Restricted Stock Units RSUs Tax Calculator Apr 23 2019 Off Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy Guide. The timing of rsu tax is exactly the same as any other.

RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. Taxes at RSU Vesting When You Take Ownership of Stock Grants. Here is the information you need to know prior to jumping in.

Rsu Tax Calculator Fidelity. Input your current marginal tax rate on vesting RSUs. Let us understand tcs tax calculation under gst with a simple example.

In order to make employee compensation more manageable for tech companies at least a portion of it can be paid in the form. Now that weve walked through how RSUs get taxed its time to actually calculate your tax bill. You will owe income tax both federal and state if.

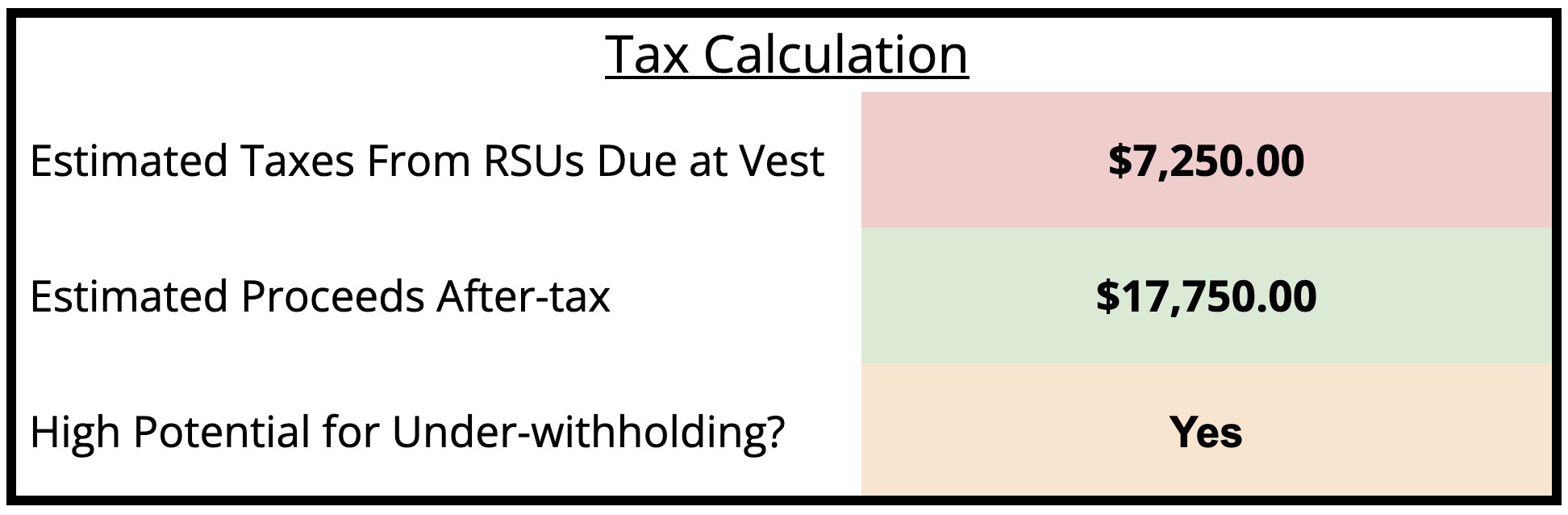

Based on your inputs it will calculate your RSU tax bill if youre likely underwithheld and the amount you potentially still own when you file your taxes. RSU Tax Calculator. RSU Taxes - A tech employees guide to tax on restricted stock units.

RSUs can also be subject to capital. 2021 2022 tax brackets and most tax credits have been verified to. -100000 Total RSU Value After Tax.

Taxes on Restricted Stock Units. Qualified espps known as qualified section 423 plans to match the tax code have to follow irs rules to receive favored treatment. Unlike the much more complicated ESPP they get taxed the same way as your income.

Different taxes apply based on the RSU lifecycle. 500 200 100000 או 310000 שח. Using the RSU Projection Calculator.

Midgard pdf from rbffwroofmasterspl. Our free salary paycheck calculator below can help you. Here is an article on employee stock options.

Estimate how much your RSU value will increase per year. The timing of RSU tax is exactly the same as any other.

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

When Do I Owe Taxes On Rsus Equity Ftw

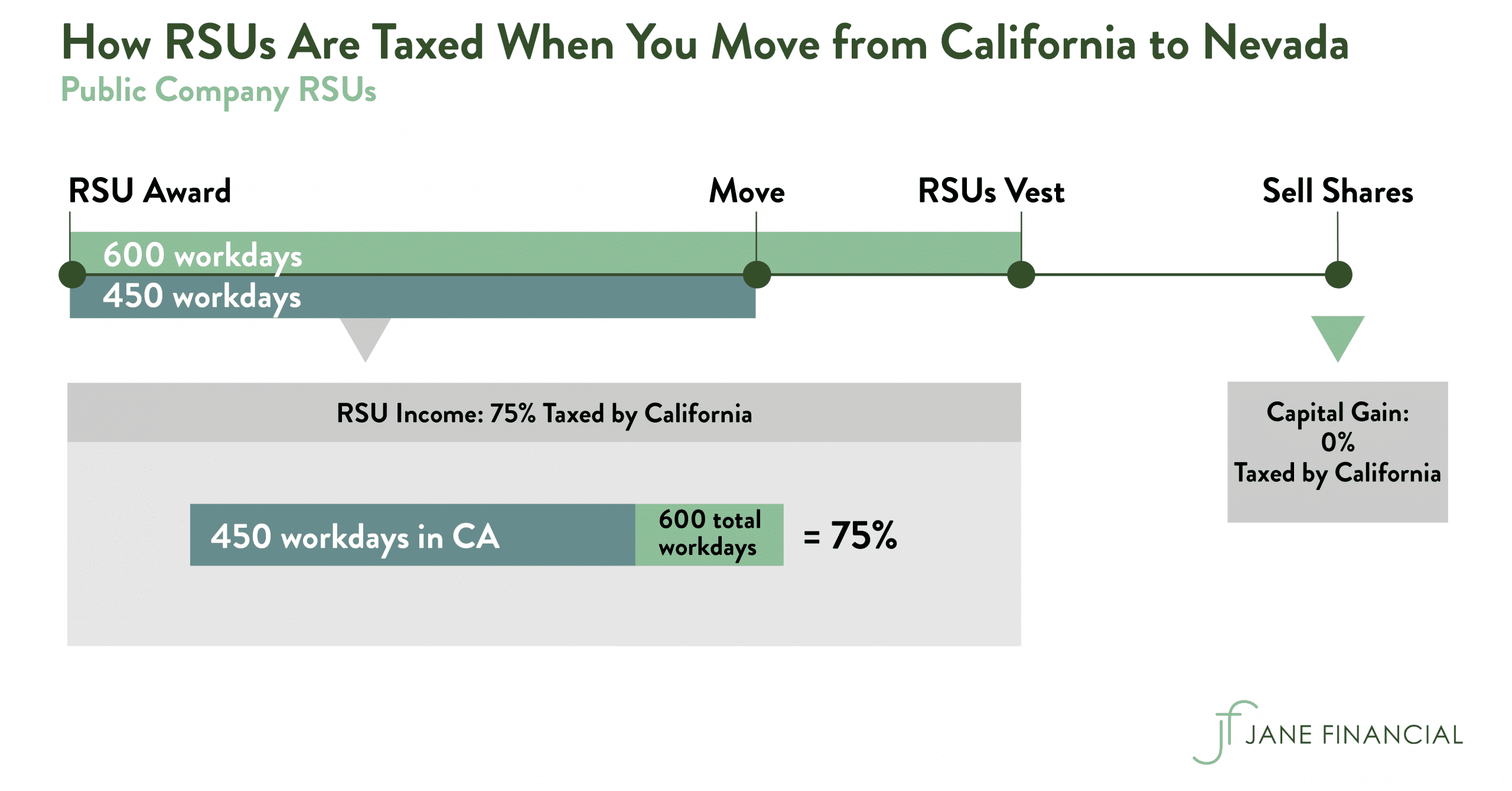

Restricted Stock Units Jane Financial

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Rsu Tax Rate Is Exactly The Same As Your Paycheck

![]()

What The Heck Is An Rsu And What Do I Do With Mine And How Is It Different From A Bonus The Planning Center

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

Explaining Rsus Or Restricted Stock Units Eqvista

Restricted Stock Units Jane Financial

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Units Jane Financial

Equity Compensation 101 Rsus Restricted Stock Units

Rsu Taxes Explained 4 Tax Strategies For 2022